Ensure Compliance and Accuracy with a Professional Australian Online Tax Return

Ensure Compliance and Accuracy with a Professional Australian Online Tax Return

Blog Article

Why You Should Take Into Consideration an Online Income Tax Return Process for Your Economic Demands

In today's fast-paced environment, the online tax return procedure provides an engaging service for handling your financial commitments successfully. The real advantage may exist in the access to specialized resources and support that can dramatically affect your tax result.

Ease of Online Declaring

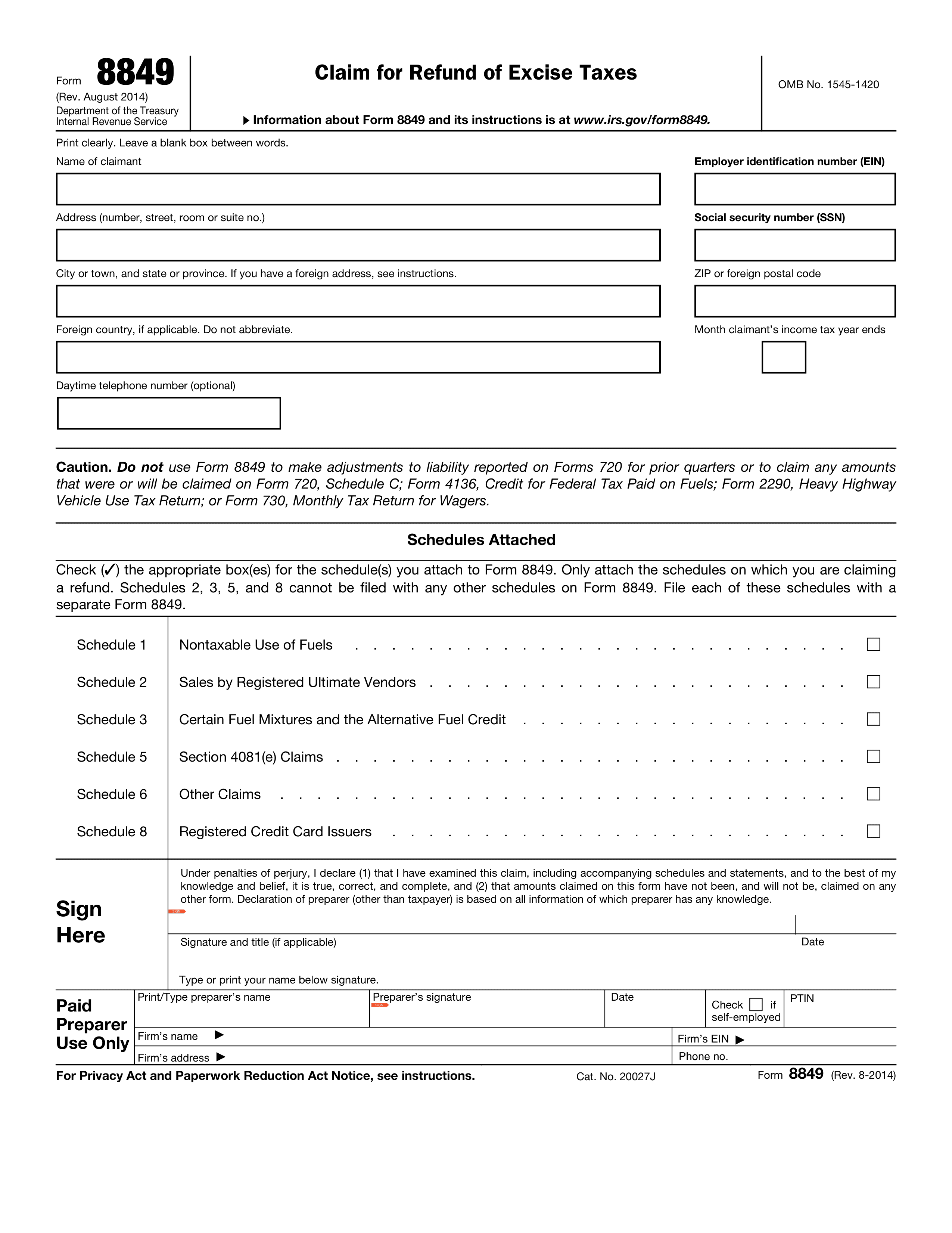

The benefit of on the internet filing has actually changed the means taxpayers approach their income tax return. In a period where time is valuable, on the internet tax obligation declaring platforms provide taxpayers with the versatility to complete their returns from the comfort of their workplaces or homes. This access gets rid of the need for physical trips to tax preparers or the blog post workplace, significantly reducing the trouble frequently connected with traditional declaring approaches.

Additionally, on the internet filing solutions offer easy to use user interfaces and step-by-step assistance, allowing individuals to navigate the procedure effortlessly. Lots of platforms incorporate features such as automated computations, error-checking, and immediate accessibility to previous year returns, improving the general declaring experience. This technological advancement not just simplifies the preparation process but also empowers taxpayers to take control of their financial duties.

Additionally, online declaring enables the smooth assimilation of numerous tax files, including 1099s and w-2s, which can frequently be imported straight into the system. This streamlining of information reduces data entry errors and improves precision, making sure an extra reputable submission (Australian Online Tax Return). Ultimately, the comfort of online filing represents a considerable shift in tax obligation prep work, aligning with the evolving needs of contemporary taxpayers

Time Performance and Rate

Timely conclusion of income tax return is an essential aspect for several taxpayers, and on the internet declaring considerably improves this facet of the process. The electronic landscape simplifies the entire income tax return process, lowering the moment called for to collect, input, and submit required info. Online tax obligation software frequently includes attributes such as pre-filled kinds, automatic computations, and easy-to-navigate user interfaces, permitting individuals to finish their returns a lot more efficiently.

Moreover, the ability to gain access to tax files and details from anywhere with an internet link gets rid of the need for physical paperwork and in-person consultations. This versatility enables taxpayers to work with their returns at their ease, thus decreasing the anxiety and time pressure typically linked with conventional declaring methods.

Cost-Effectiveness of Digital Solutions

While many taxpayers may originally perceive online tax obligation declaring options as an included expenditure, a closer examination reveals their inherent cost-effectiveness. Digital systems commonly come with lower charges contrasted to standard tax obligation preparation services. Many on the internet carriers supply tiered pricing structures that permit taxpayers to pay only for the services they really need, decreasing unneeded expenses.

Additionally, the automation integral in online options streamlines the declaring procedure, decreasing the possibility of human mistake and the potential for pricey alterations or fines. This efficiency converts to substantial time financial savings, which can relate to economic cost savings when thinking about the per hour prices of professional tax preparers.

Improved Accuracy and Safety And Security

Along with boosted accuracy, on-line tax filing likewise focuses on the safety of delicate personal and economic information. Credible online tax services use durable encryption innovations to secure information transmission and storage, dramatically reducing the danger of identification theft and fraud. Routine safety and security updates and compliance with sector criteria better strengthen these defenses, giving comfort for users.

Furthermore, the capacity to access tax obligation papers and info firmly from anywhere permits greater control over individual monetary information. Individuals can quickly track their filing standing and fetch essential documents without the risk connected with physical duplicates. In general, the mix of enhanced accuracy and security makes online tax obligation submitting a sensible choice for individuals seeking to streamline their tax prep work process.

Accessibility to Professional Support

Accessing professional assistance is a considerable benefit of on-line tax obligation filing systems, giving users with advice from educated specialists throughout the tax obligation preparation process. Numerous of get redirected here these systems provide access to certified tax specialists who can help with intricate tax obligation problems, guaranteeing that individuals make educated decisions while maximizing deductions and credits.

This expert assistance is usually available with numerous networks, including real-time conversation, video telephone calls, and phone assessments. Such access enables taxpayers to seek explanation on particular tax obligation laws and regulations or obtain individualized advice customized to their special monetary scenarios (Australian Online Tax Return). Having a professional on hand can alleviate the tension associated with tax filing, particularly for individuals dealing with challenging monetary circumstances or those strange with the most recent tax obligation codes.

Furthermore, on-line tax platforms regularly offer a wide range of resources, such as training video clips, short articles, and Frequently asked questions, boosting individuals' understanding of their tax Read Full Article commitments. This thorough support system not just fosters self-confidence during the declaring procedure yet likewise furnishes users with valuable knowledge for future tax years. Inevitably, leveraging expert support via online tax return procedures can cause even more accurate filings and enhanced economic outcomes.

Final Thought

In verdict, the on-line tax return process presents substantial advantages for individuals looking for to manage their economic requirements efficiently. Accepting digital remedies for tax obligation prep work eventually represents a forward-thinking strategy to financial monitoring in an increasingly electronic world.

Timely completion of tax obligation returns is an essential element for several taxpayers, and on the internet declaring substantially boosts this facet of the procedure. By directing individuals with the filing process with intuitive prompts and error notifies, on-line solutions help to eliminate usual errors, leading to a much more accurate tax obligation return.

In general, the mix of heightened precision and safety and security makes on the internet tax filing a sensible option for people looking for to streamline their tax obligation prep work procedure.

Having a professional on hand can minimize the anxiety linked with tax obligation declaring, especially for people encountering challenging monetary circumstances or those strange with the this website latest tax codes.

Additionally, online tax obligation platforms frequently give a wide range of sources, such as instructional video clips, short articles, and Frequently asked questions, enhancing customers' understanding of their tax commitments.

Report this page